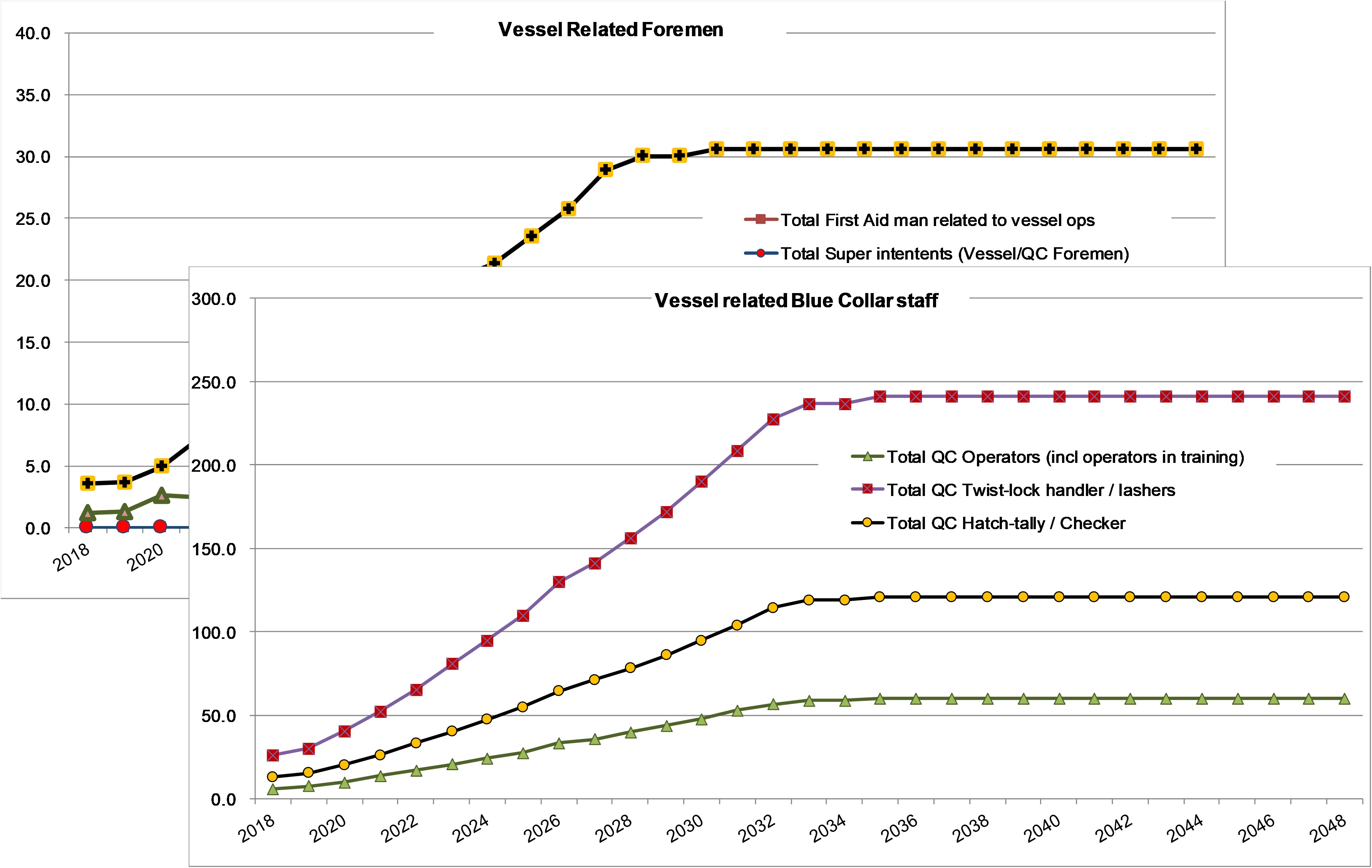

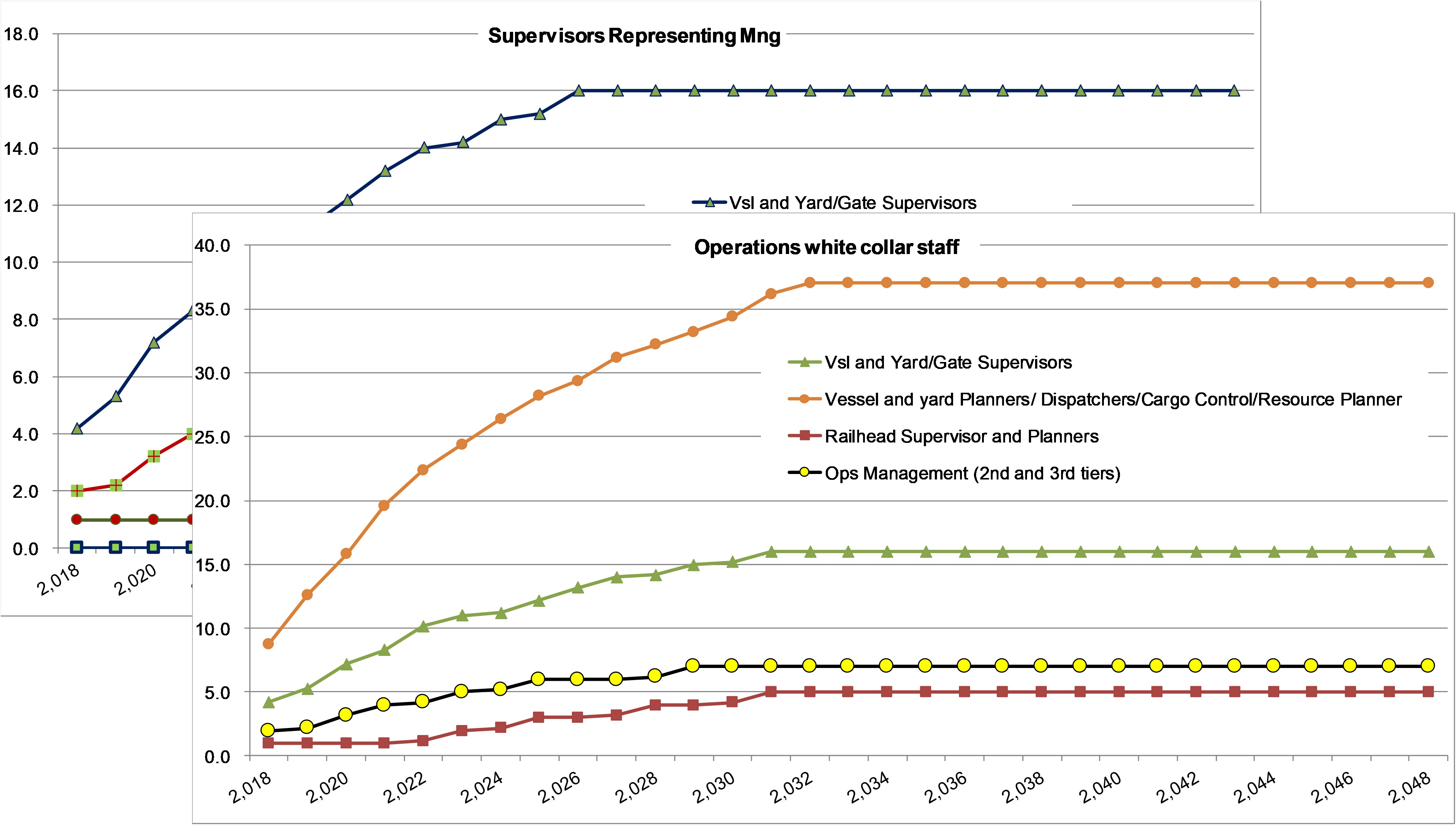

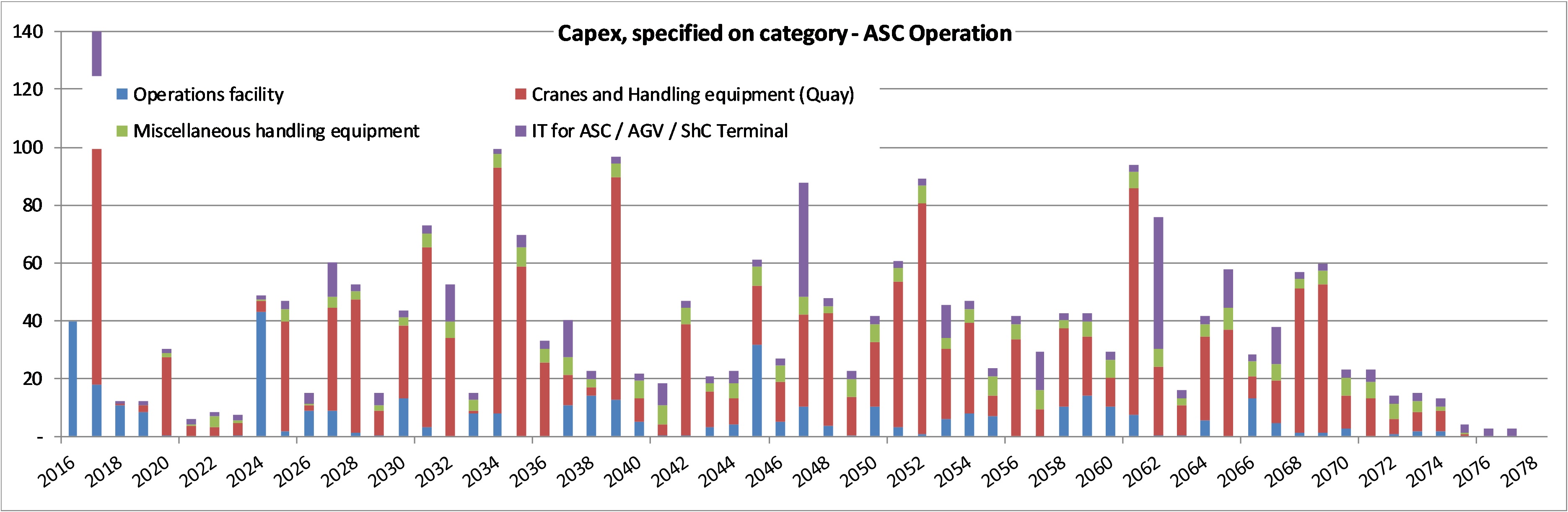

Seaport Group have one of the most comprehensive financial and cost estimation models in the industry, with integrated modules for detailed resource estimations (with various labour rules), operations cost estimation, energy consumption estimations, facility and equipment maintenance.–Business cases, financial evaluations, overall project evaluations, and cost estimations of marine terminals have always formed a strong practice area for Seaport.